With the continuous advancement of information technology and the promotion of the digital revolution, the optical module market is facing new opportunities and challenges, especially in the field of 10G optical transceivers, which will continue to grow in the next few years.

Market demand for photodetector chips is primarily concentrated in telecommunications and data communication sectors, with rapid growth observed in traditional communication fields and emerging applications such as LiDAR for autonomous vehicles, 3D VCSEL for consumer electronics, sensing, and power systems. The telecommunications segment has shown a declining trend due to slowed fixed and wireless access network construction, leading to reduced demand for 100G PON optical networks, which significantly impacts the overall market. Meanwhile, demand in the data communication sector and other emerging fields continues to rise, particularly for 25G and above, directly driving market development.

Currently, demand for sub-10G optical modules remains the largest, primarily driven by significant requirements from access network PON modules. However, as the deployment of 100M networks nears completion and market saturation increases, demand for sub-10G optical modules is gradually decline. Demand for 10G and 25G fiber transceivers will continue to grow, with sustained long-term expansion particularly expected for 10G APD and 50G+ PIN PD technologies. The demand for 10G APD is mainly benefiting from large-scale deployment of 10G PON networks. While current demand for 50G and higher photodetector chips remains relatively modest, growth momentum is strong, primarily driven by increasing requirements for 200G/400G and 800G optical modules.

The explosive growth in data traffic is driving a continuous increase in the number of data centers worldwide, further underscoring the critical role of transceiver modules. As end-user services evolve, the volume of data traffic that needs to be processed within a data center far exceeds what must be transmitted externally, leading to escalating data processing complexity. The application of fiber transceiver within data centers has significantly enhanced their computing power and data exchange capabilities.

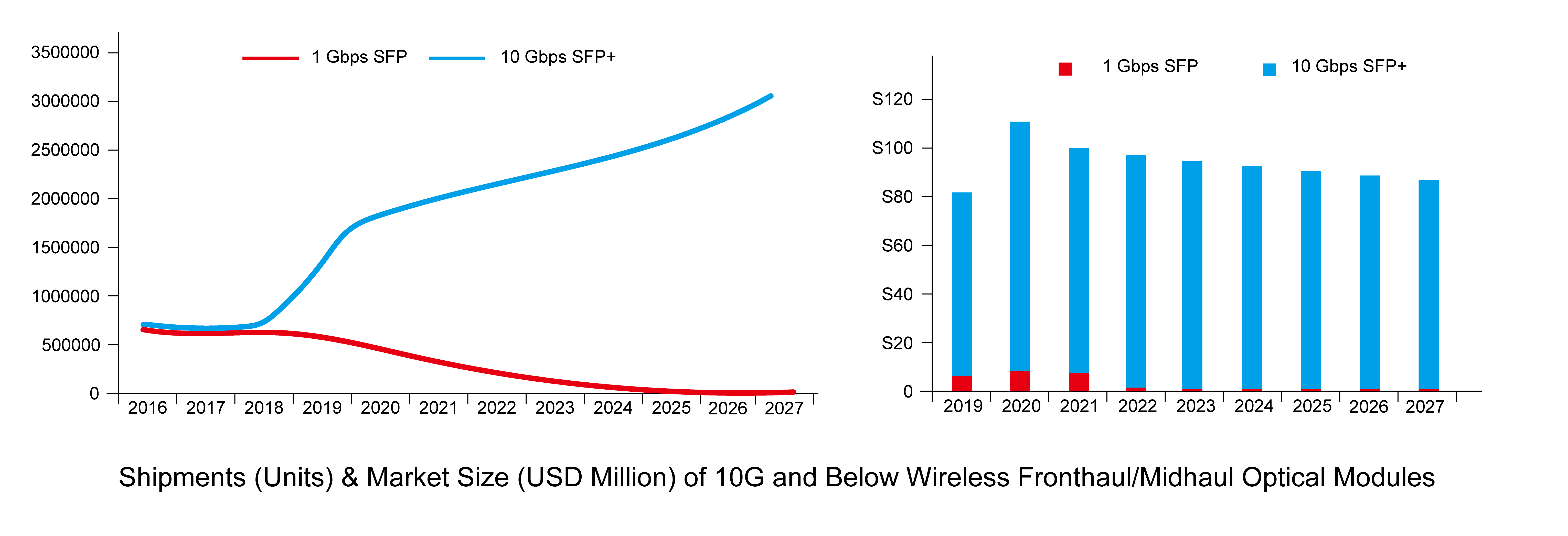

The rising adoption of 5G users and the continuous enrichment of 5G applications are driving persistent growth in 5G traffic, subsequently driving the need for capacity expansion in mid-haul and backhaul networks. LightCounting forecasts that annual shipments of 10G optical transceivers for 5G mid-backhaul will increase from 2.1 million units in 2022 to 3.06 million by 2027, representing a five-year CAGR of 7.68%. This consistent demand has stabilized the market for 10G-and-below transceiver modules at approximately US$90 million.

In summary, the 10G optical transceiver market is in a critical phase of dynamic evolution, presenting both abundant opportunities and challenges. The rapid expansion of data centers, coupled with stable demand from wireline access and wireless backhaul sectors, will serve as key drivers for this market. As an experienced manufacturer, UnitekFiber is committed to providing you with high-quality, reliable optical modules. If you have any questions or requirements, please do not hesitate to contact our team.